|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding the Housing Refinance Program for HomeownersThe housing refinance program offers homeowners an opportunity to lower their mortgage interest rates and adjust loan terms. Refinancing can be a strategic financial move, but it's important to understand how it works. What is a Housing Refinance Program?A housing refinance program allows homeowners to replace their existing mortgage with a new one, usually with better terms. The main goal is to reduce monthly payments or switch from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage. Benefits of Refinancing

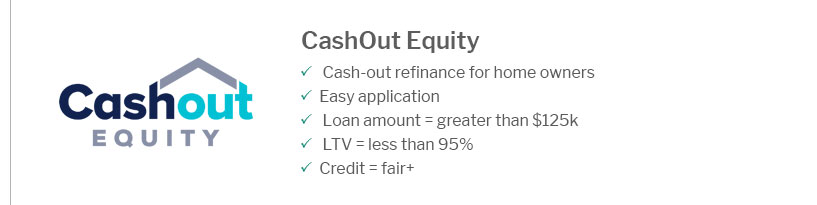

Considerations Before RefinancingBefore deciding to refinance, it's crucial to consider the associated costs and evaluate if the benefits outweigh these expenses. Assess your financial goals and current market conditions. Types of Refinance ProgramsThere are various types of refinance programs available, each catering to different needs and situations. Rate and Term RefinanceThis option focuses on changing the interest rate, loan term, or both without altering the loan amount. It's ideal for those looking to lower monthly payments. Cash-Out RefinanceWith a cash-out refinance, homeowners can borrow more than the current mortgage balance and receive the difference in cash. This can be useful for home improvements or paying off high-interest debt. To explore different refinance options, you can review the top 10 refinance lenders for competitive rates and terms. Adjustable-Rate Mortgage (ARM) RefinanceSwitching from an ARM to a fixed-rate mortgage can provide stability in monthly payments. It's beneficial when interest rates are expected to rise. Homeowners interested in ARMs might consider the best 5 1 arm refinance rates available. FAQHow much can I save by refinancing my mortgage?The savings from refinancing depend on the new interest rate, loan term, and closing costs. Homeowners can save thousands over the life of the loan if rates are significantly lower. What are the costs associated with refinancing?Refinancing typically involves closing costs similar to those of the original mortgage, such as application fees, appraisal fees, and title insurance. It's essential to calculate whether these costs are justified by the savings. Can I refinance if I have bad credit?While having a higher credit score can secure better rates, options exist for those with less-than-perfect credit, though they may come with higher interest rates. Consulting with multiple lenders can provide different possibilities. https://www.treadstonemortgage.com/blog/harp-refinance/

Learn about HARP refinancing, the options you have to refinance your home loan, and if refinancing is right for you! Contact us today. https://www.usa.gov/government-home-loans

FHA loans. The Federal Housing Administration (FHA) manages the FHA loan program. It helps homebuyers by insuring their loans so lenders can ... https://www.michigan.gov/mshda/pathway-to-housing/mi-home-loan

The MI Home Loan program is a mortgage product that is available to first-time homebuyers state-wide and repeat homebuyers in targeted areas.

|

|---|